Navigating the Challenges of an Aging Workforce

2/8/2024 8:00:00 AM

Over the past few years, finding and retaining qualified workers has been a challenge for businesses because of the strong job market and an aging workforce. While this is true across the country, it is even more pronounced in the Midwest. There are early signs that labor markets are slowly softening, but long-term trends suggest that hiring may continue to be difficult. These conditions make it important for business leaders to think strategically in order to manage an aging workforce into the future.

Labor Markets Appear to be Normalizing Slowly

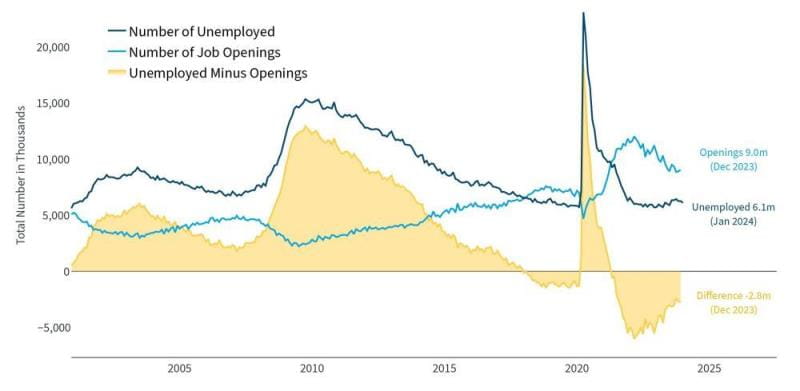

In early 2023, the national unemployment rate hit its lowest level since the late 1960s, dipping down to just 3.4%. At its peak, there were more than two job openings for every unemployed worker in the country, as measured by the Job Openings and Labor Turnover Survey. In the Midwest – specifically in Minnesota, North Dakota, South Dakota and Wisconsin – there were more than three job openings per worker, in aggregate.

This labor market strength resulted in strong wage growth as employers competed for a limited supply of skilled workers. Indeed, finding and retaining skilled workers has been a persistent challenge for employers over the last three years. While those conditions are good for individuals and households in this inflationary environment, they have placed pressures on businesses and profit margins.

Fortunately, the labor market is showing some signs of normalizing. The national unemployment rate has increased to 3.7% as of January 2024, and the number of job openings has fallen significantly. At the national level, the number of job openings per unemployed worker has fallen to 1.5. This decline has been mirrored in Minnesota, North Dakota and South Dakota, where the aggregate level has fallen to 2.2 job openings per unemployed worker.

As demand for workers has fallen, so has the pace of wage increases required to compete for qualified employees. At the post-pandemic peak in Q2 2022, wages for private employees increased 5.7% on a year-over-year basis, as measured by the Employment Cost Index. Wage growth has since decelerated to 4.3% as of Q4 2023, although that figure remains well above the average of 2.2% during the period from the Great Recession to the pandemic.

Further signs of a normalizing labor market in 2024 would be a welcome sign for business leaders, although long-term trends suggest challenges will remain.

Long-term demographic trends add pressure to the labor market

Looking beyond 2024, demographic data suggests that the labor force participation rate – which measures the percentage of the population that is willing and able to work – could decline over the next decade as workers age. Labor force participation peaked in the early 2000s before beginning a gradual decline, eventually leveling off in the mid-2010s. However, with aging Baby Boomers and declining birth rates, the median age in the U.S. has increased from 35.8 to 39.0 since 2000. Further drops in the participation rate are likely as the population continues to age.

In the Midwest states presented in the accompanying chart, the labor force participation rate has mirrored that of the broader nation, suggesting that in the long term, labor force participation in the Midwest will decline alongside national participation. By 2032, the U.S. Census Bureau projects that the labor force participation rate will fall to nearly 60%. These trends suggest that it will likely remain challenging to hire qualified workers.

Developing labor for years to come

Given these challenges, how can businesses manage through an aging workforce to support long-term growth? While there are many possible solutions, business leaders should consider focusing on developing and retaining existing workers while also investing in operational efficiency.

For example, employers may find that on-the-job training programs such as apprenticeships provide valuable opportunities to develop critical talent. Research by the Department of Labor1 found that employers implementing apprenticeship programs saw a strong and positive net return on investment on aggregate. The research shows that despite the upfront investment, the positive impact of skilled employees, reduced turnover, and high employee engagement outweighed the initial costs over the long term. Conservative estimates suggest that more than two-thirds of employers saw a positive return on investment after considering longer-term benefits.

Beyond apprenticeship programs, businesses should seek to create work environments that encourage employee engagement and growth. For example, succession planning represents both a challenge and an opportunity for business owners. The transfer of business leadership to a new cohort can be a period of heightened uncertainty, but providing young leaders with the opportunity to advance within a business can help to alleviate succession planning uncertainty and increase employee retention.

Finally, business leaders should continue to invest in automation and technology. Investing in software tools can streamline management operations, while new equipment may significantly increase the output of a business. Although these options require an upfront investment, they can increase worker productivity and help businesses grow sustainably over time. Additionally, by increasing productivity in one area of the business, leaders may have the opportunity to reallocate limited human capital to where it is needed most.

Investing in the future

These strategies highlight the importance of investing in labor and efficiency. They also underscore the role of training and technology to maximize worker productivity and retention. Combined, these strategic initiatives can help business leaders continue to expand their operations while navigating long-term labor market challenges. When considering investment priorities, strong banking relationships can help leaders allocate and source capital in order to meet the demands of their growing businesses.

1Kuehn, Daniel, Siobhan Mills De La Rosa, Robert Lerman, and Kevin Hollenbeck. 2022. Do Employers Earn Positive Returns to Investments in Apprenticeship? Evidence from Registered Programs under the American Apprenticeship Initiative. Report prepared for U.S. Department of Labor, Employment and Training Administration. Rockville, MD: Abt Associates; and Washington, DC: Urban Institute.

Related Content

Insights

Economic Outlook

Read our latest Economic Outlook from Greg Sweeney, Bell Bank’s chief investment officer.

Insights